When it comes to buying a home, choosing the right type of mortgage is one of the most important decisions you’ll make. Two of the most common options are FHA loans and conventional mortgages. Each has its own set of advantages and disadvantages, and understanding these can help you make an informed decision that aligns with your financial goals and circumstances.

In this blog, we’ll break down the pros and cons of FHA loans versus conventional mortgages in detail. We’ll explore key factors like credit score requirements, down payments, interest rates, mortgage insurance, loan limits, property standards, and more. By the end of this article, you’ll have a clear understanding of which option might be better for your situation.

What Are FHA Loans?

FHA loans are mortgages insured by the Federal Housing Administration (FHA), a government agency. These loans are designed to make homeownership more accessible for borrowers who may not qualify for conventional loans due to lower credit scores or limited savings for a down payment.

Key Features of FHA Loans:

- Lower Credit Score Requirements: Borrowers with credit scores as low as 500 may qualify.

- Low Down Payment Options: You can put down as little as 3.5% if your credit score is 580 or higher.

- Government-Backed Insurance: The FHA insures the loan, reducing risk for lenders.

- Primary Residence Only: FHA loans can only be used to purchase a primary residence (not vacation homes or investment properties).

- Mortgage Insurance Premiums (MIP): Borrowers must pay both upfront and annual mortgage insurance premiums.

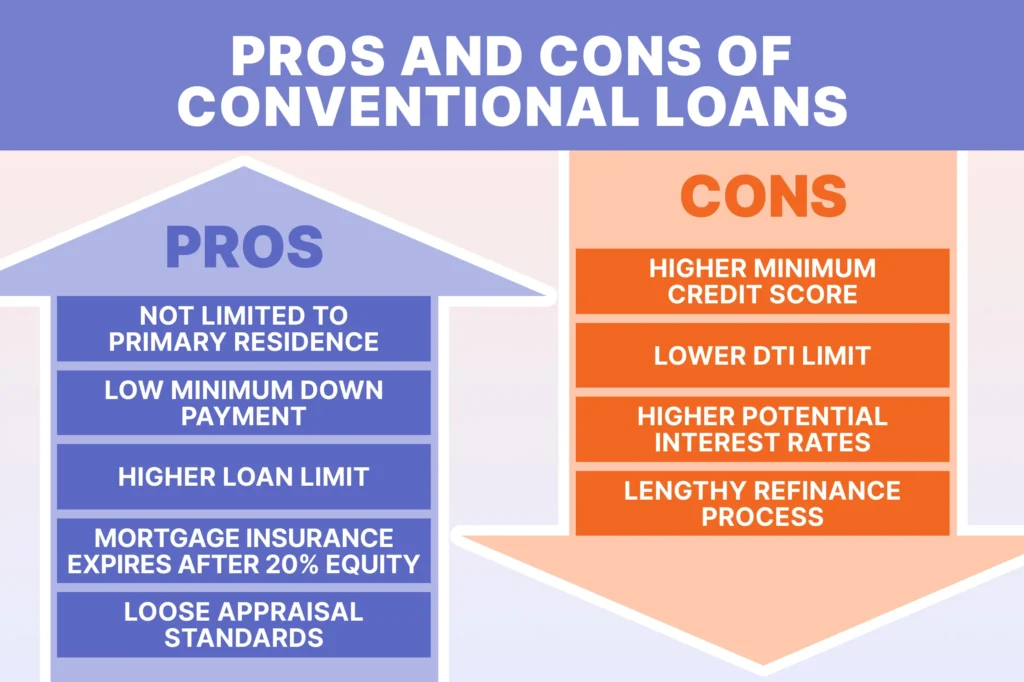

What Are Conventional Mortgages?

Conventional mortgages are home loans that are not backed by any government agency. Instead, they follow guidelines set by Fannie Mae and Freddie Mac, two government-sponsored enterprises that buy and sell mortgages on the secondary market.

Key Features of Conventional Mortgages:

- Higher Credit Score Requirements: Typically require a minimum credit score of 620.

- Flexible Property Types: Can be used for primary residences, second homes, or investment properties.

- Private Mortgage Insurance (PMI): Required if you put less than 20% down but can be canceled once you reach 20% equity.

- No Government Backing: Lenders bear all the risk if borrowers default on their loans.

Comparing FHA Loans vs. Conventional Mortgages

Let’s dive into specific areas where these two types of loans differ so you can weigh their pros and cons effectively.

1. Credit Score Requirements

One major difference between FHA loans and conventional mortgages is the minimum credit score required to qualify.

FHA Loans:

- Minimum credit score: 500 (with at least a 10% down payment).

- Minimum credit score: 580 (with a 3.5% down payment).

- More lenient on past financial issues like bankruptcy or foreclosure.

Conventional Mortgages:

- Minimum credit score: Typically 620 or higher.

- Higher scores result in better interest rates and lower PMI costs.

Pros for FHA Loans:

- Easier qualification for borrowers with lower credit scores.

Cons for FHA Loans:

- Borrowers with excellent credit may find better terms with conventional loans.

2. Down Payment Requirements

The amount you need to put down upfront varies significantly between these two loan types.

FHA Loans:

- Require as little as 3.5% down if your credit score is at least 580.

- Require a minimum of 10% down if your credit score is between 500–579.

Conventional Mortgages:

- Require as little as 3% down through programs like Fannie Mae’s HomeReady® or Freddie Mac’s Home Possible®.

- A larger down payment (20%) allows you to avoid PMI altogether.

Pros for FHA Loans:

- Lower upfront cost makes homeownership accessible to more people.

Cons for FHA Loans:

- Even with a small down payment, mortgage insurance premiums increase overall costs over time.

3. Interest Rates

Interest rates play a crucial role in determining how much you’ll pay over the life of your loan.

FHA Loans:

- Often have lower base interest rates compared to conventional loans because they’re government-backed.

Conventional Mortgages:

- Interest rates depend heavily on your credit score; borrowers with excellent credit often get better rates than those offered by FHA loans.

Pros for Conventional Mortgages:

- Potentially lower long-term costs if you have strong financial credentials.

Cons for Conventional Mortgages:

- Higher interest rates for borrowers with average or below-average credit scores compared to FHA options.

4. Mortgage Insurance

Both types of loans require some form of mortgage insurance if you don’t meet certain criteria—but there are key differences in how they work.

FHA Loans:

- Upfront Mortgage Insurance Premium (UFMIP):

- Equal to 1.75% of the loan amount; can be rolled into the loan balance.

- Annual Mortgage Insurance Premium (MIP):

- Ranges from 0.15%–0.75%, depending on loan size and term length.

- Required regardless of how much money you put down initially.

- Cannot be canceled unless you refinance into a conventional loan after building sufficient equity.

Conventional Mortgages:

- Private Mortgage Insurance (PMI):

- Required if your down payment is less than 20%.

- Costs vary based on your credit score and loan-to-value ratio (LTV).

- Can be canceled once you reach at least 20% equity in your home.

Pros for Conventional Mortgages:

- PMI can eventually be removed, reducing monthly payments over time.

Cons for FHA Loans:

- MIP lasts throughout the life of the loan unless refinanced into another product type later on.

5. Debt-to-Income Ratio (DTI)

Your DTI ratio measures how much debt you have relative to your income—a critical factor in qualifying for any mortgage type.

FHA Loans:

- Maximum DTI Ratio:

- Generally up to 50%, though exceptions exist based on compensating factors like strong savings or high income stability.

Conventional Mortgages:

- Maximum DTI Ratio:

- Typically capped at around 43%-45%.

- Stricter guidelines mean fewer exceptions compared to FHA rules.

Pros for FHA Loans: 1.- Allows higher DTIs—helpful when balancing other debts alongside housing expenses

6. Loan Limits

Loan limits determine the maximum amount you can borrow under each loan type, and these limits vary depending on location and property type.

FHA Loans:

- Loan limits are set by the Federal Housing Administration and vary by county.

- Typically lower than conventional loan limits.

- Designed to cater to moderate-income borrowers.

Conventional Mortgages:

- Loan limits are determined by Fannie Mae and Freddie Mac.

- Higher loan limits compared to FHA loans.

- Jumbo loans are available for those needing amounts above conforming loan limits.

Pros for Conventional Mortgages:

- Higher loan limits make them suitable for purchasing more expensive properties.

Cons for FHA Loans:

- Lower loan limits may restrict your ability to buy in high-cost areas.

7. Property Standards

The condition of the property you’re buying plays a significant role in determining which loan is better suited for your needs.

FHA Loans:

- Require the property to meet strict safety, security, and livability standards.

- The home must pass an FHA appraisal, which includes both valuation and inspection components.

Conventional Mortgages:

- More lenient on property conditions compared to FHA loans.

- Appraisals focus primarily on market value rather than strict safety standards.

Pros for Conventional Mortgages:

- Greater flexibility when purchasing older homes or fixer-uppers.

Cons for FHA Loans:

- May limit options if the property doesn’t meet stringent requirements.

8. Closing Costs

Closing costs include fees like appraisal charges, title insurance, and lender fees. These costs can differ between FHA loans and conventional mortgages.

FHA Loans:

- Allow sellers to contribute up to 6% of the purchase price toward closing costs.

- Upfront Mortgage Insurance Premium (UFMIP) adds to overall closing expenses unless rolled into the loan balance.

Conventional Mortgages:

- Seller contributions toward closing costs are typically capped at 3%-6%, depending on your down payment size.

- No upfront mortgage insurance fee unless required by PMI terms.

Pros for FHA Loans:

- Higher seller contribution limit can reduce out-of-pocket expenses at closing.

Cons for Conventional Mortgages:

- Lower seller contribution cap may require more cash upfront from buyers with smaller down payments.

9. Refinancing Options

Refinancing allows homeowners to replace their existing mortgage with a new one—often at better terms or rates. Both FHA loans and conventional mortgages offer refinancing options but differ in flexibility.

FHA Loans:

- Streamline Refinance Program allows borrowers to refinance without extensive documentation or an appraisal.

- Can be refinanced into a conventional mortgage once sufficient equity is built up (to eliminate MIP).

Conventional Mortgages:

- Offer various refinancing options, including rate-and-term refinance or cash-out refinance.

- Typically require higher credit scores than FHA streamline refinancing programs.

Pros for FHA Loans:

- Easier refinancing process through streamline programs with minimal paperwork requirements.

Cons for Conventional Mortgages:

- Stricter qualification criteria make refinancing less accessible for some borrowers compared to FHA options.

Conclusion

When deciding between an FHA loan and a conventional mortgage, it’s essential to weigh the pros and cons based on your financial situation, credit score, savings, and long-term goals.

Choose an FHA Loan if:

- You have a lower credit score or limited savings for a down payment.

- You need more flexible debt-to-income ratio requirements.

- You’re okay with paying mortgage insurance premiums over the life of the loan or until you refinance later into another product type like a conventional mortgage.

Opt for a Conventional Mortgage if:

- You have good-to-excellent credit that qualifies you for competitive interest rates.

- You want flexibility in choosing property types (e.g., second homes or investment properties).

- You aim to avoid long-term mortgage insurance costs by putting down at least 20%.

Ultimately, there’s no one-size-fits-all answer—it depends entirely on your unique circumstances! Take time to evaluate your financial health, consult with lenders about prequalification options, and consider speaking with a trusted financial advisor before making your final decision. Homeownership is one of life’s most significant investments; choosing the right financing option will set you up for success in achieving this milestone!

Leave a Reply