-

Foreclosure is one of the most stressful situations a homeowner can face. Losing your home not only disrupts your life but also damages your credit score and financial future. However, foreclosure is not inevitable. With the right strategies and proactive steps, you can avoid foreclosure and regain control of your finances. This guide will provide…

-

If you’re considering buying a home in a rural or suburban area, USDA loans might be the perfect financing option for you. These government-backed loans are specifically designed to make homeownership more accessible for low- to moderate-income families. With benefits like zero down payment and competitive interest rates, USDA loans have become an attractive choice…

-

The number of self-employed individuals is growing rapidly, with more people choosing freelance work, entrepreneurship, or contract-based jobs over traditional employment. While this shift offers flexibility and independence, it can also create challenges when it comes to securing a mortgage. For self-employed individuals, qualifying for a mortgage often requires additional preparation and documentation compared to…

-

When it comes to purchasing a home, most buyers rely on traditional mortgage loans. However, for those looking to buy high-value properties or homes in expensive real estate markets, a standard loan may not be enough. This is where jumbo loans come into play. If you’re considering buying a luxury property or a home that…

-

![The Top Tax Benefits of Owning a Home in [2025]](https://magistvapkk.info/wp-content/uploads/2025/03/Home-Loan-Tax-Benefit.jpg)

Owning a home is one of the most significant financial milestones in life. Beyond the pride and stability it brings, homeownership comes with several tax benefits that can save you thousands of dollars annually. As we step into 2025, understanding these tax advantages is crucial for homeowners looking to maximize their savings during tax season.…

-

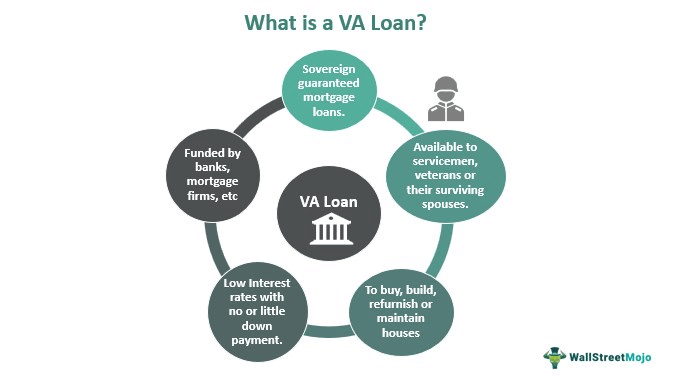

Veterans Affairs (VA) loans are a powerful financial tool designed specifically for veterans, active-duty service members, and eligible surviving spouses. These loans offer unique benefits that make homeownership more accessible and affordable for those who have served in the military. In this comprehensive guide, we will break down everything you need to know about VA…

-

Buying a home is one of the most significant financial decisions you will ever make. While many people focus on the purchase price and monthly mortgage payments, there are numerous hidden costs that can catch buyers off guard. These costs can add up quickly and impact your budget if you’re not prepared. In this article,…

-

Buying a house is one of the biggest financial decisions you’ll ever make. It’s exciting, but it can also be overwhelming if you’re not sure how much house you can afford. The key to making a smart home-buying decision is understanding your finances and setting realistic expectations. This guide will help you figure out how…

-

Interest rates play a critical role in the housing market and directly impact your mortgage payments. Whether you’re a first-time homebuyer or someone looking to refinance, understanding how rising interest rates affect your mortgage is essential for making informed financial decisions. This article will break down the effects of rising interest rates on your mortgage…

-

When buying a home, there are numerous costs that potential homeowners need to consider. One of these costs is Private Mortgage Insurance (PMI), which can significantly impact your monthly mortgage payments. For many first-time buyers or those unable to make a large down payment, PMI may be a necessary expense. However, understanding what PMI is,…